Despite President Donald Trump promising that things will be cheaper for the average American in his quest to make America ‘great’ again, he seems to be off to a sluggish start. During his tariff announcement, the POTUS said groceries are down, whereas in reality, the likes of bread and toilet paper have remained the same, while milk and gasoline have seemingly gone up. But hey, at least peanut butter and eggs are down.

There are already fears that Donald Trump‘s trade tariffs could upend the tech world, especially as China is hit with a hefty 54% reciprocal tariff. As so many parts or whole products themselves come from China, we’re already bracing for the likes of the iPhone to go through the roof. Nintendo has even pulled back the release date of the Nintendo Switch 2 amid concerns over the import tariffs, while Trump is accused of triggering a global trade war.

Amazon’s prices could soon be affecting the customer (Bloomberg / Contributor / Amazon)

Amazon stocks dipped by 6% in the aftermath of the announcement, and Jeff Bezos lost nearly $16 billion. Despite Amazon’s credentials as a figurehead of the American commerce scene, its legacy as a multinational organization could soon see prices rise.

As noted by Intelligencer, Amazon lost a tenth of its value on Thursday alone. Down 28% overall, it’s suggested that Amazon’s bid for TikTok could put it on the wrong side of China. Trump previously toyed with removing the de minimi, which meant consumers didn’t have to pay duty and import tax on daily shipments under $800. This saw the likes of Shein and Temu flourish, but without it, things could largely be on par with Amazon’s pricing.

Amazon relies heavily on its relationship with China thanks to a huge number of its goods being manufactured there. The online marketplace is stocked with third-party merchants, most of them based in China. As tech and e-commerce analyst Juozas Kaziukėnas reminds us, Amazon has “only accelerated its dependence on China. It has massive training centers for sellers in China, it organizes conferences for sellers. Any tariffs on China obviously have a massive impact on everything Amazon sells.”

With Amazon lacking the ‘headroom’ to take on the tariffs, prices could soon climb.

Using the example of spatulas, the outlet notes that prices going up for cheaper spatulas on Amazon will likely lead to prices on other spatulas you might buy also going up. Amazon’s lower-end competitors will be neutralized, and consumers will go back to Amazon, and although this could be a win for the shopping giant, it’s ultimately we who lose out here.

Kaziukėnas concluded: “During recessions, customers go for a cheaper alternative. Amazon equally benefits from situations like this.”

Even if discretionary spending goes down, Amazon has diversified enough that it would likely survive while putting its prices up.

With the Magnificent 7 of Amazon, Alphabet, Apple, Meta, Microsoft, Nvidia, and Tesla wiping almost a trillion dollars off their collective worth within a day of the tariffs being announced, Trump could be entering the history books for all the wrong reasons. Even ‘First Buddy’ Elon Musk has spoken out about them, and even though the POTUS has been accused of levying these tariffs as a way to get his enemies to fall in line and to help America politically, there are major fears about what impact they could have on our shopping baskets.

Featured Image Credit: NurPhoto / Contributor via Getty

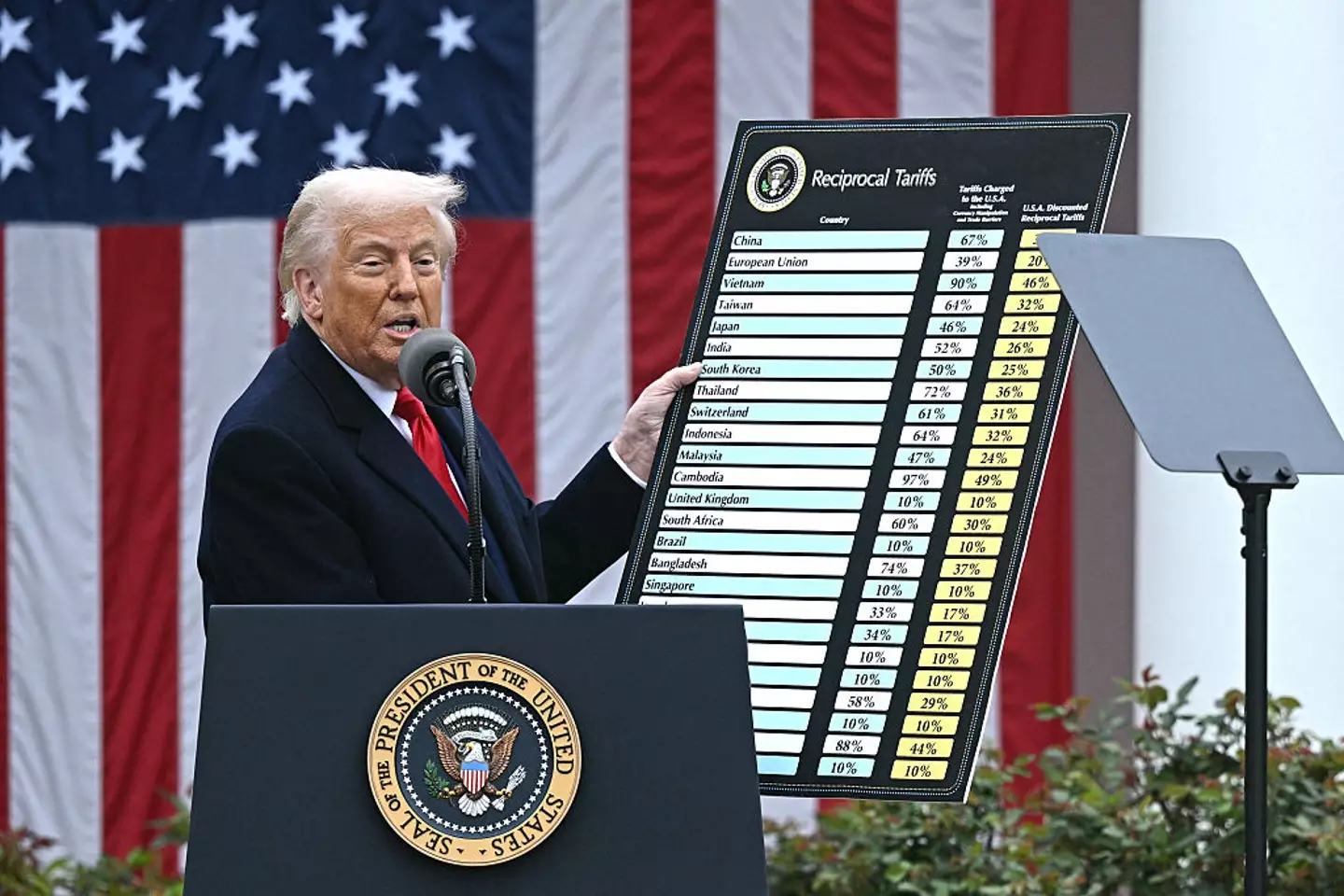

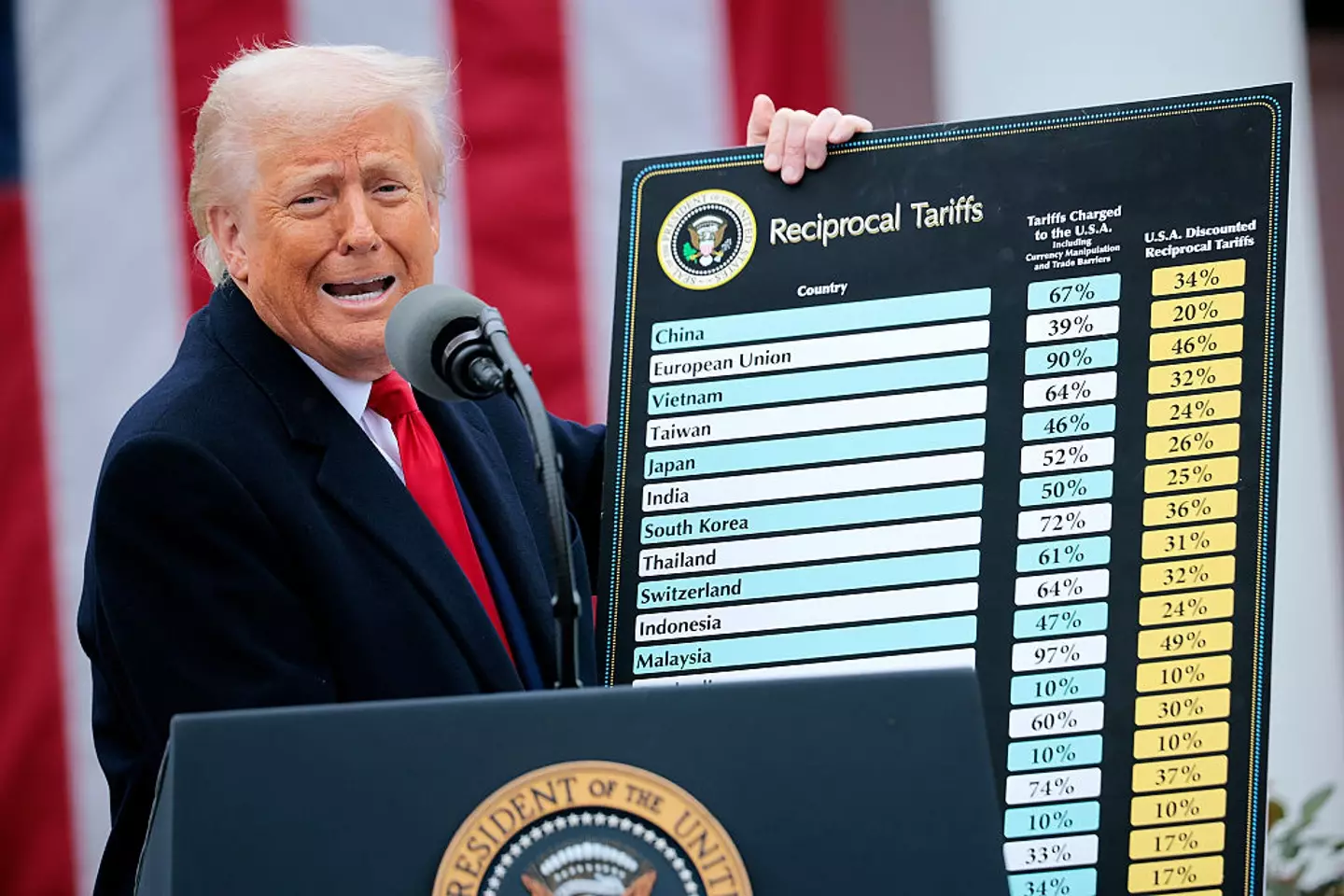

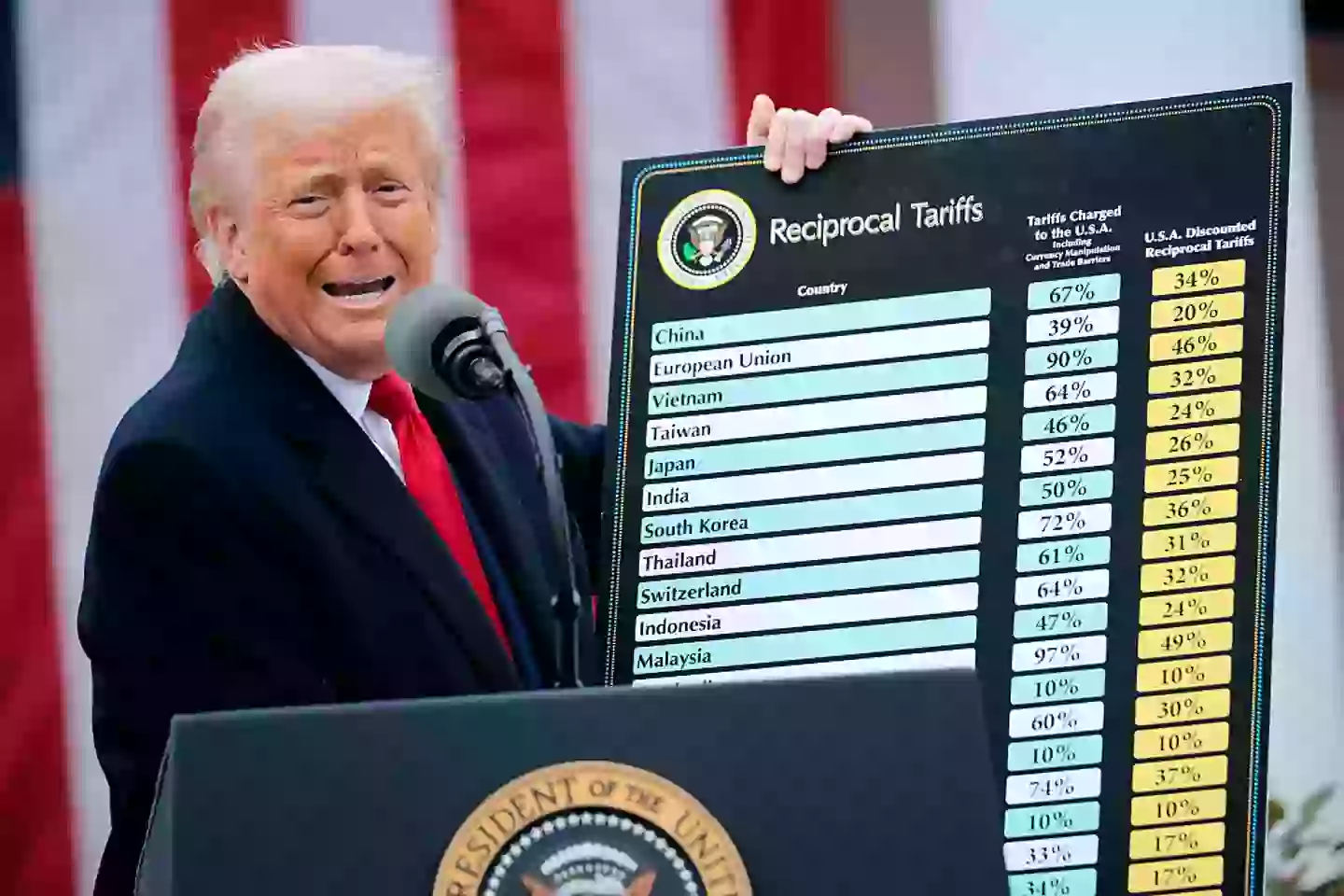

President Donald Trump warned us to brace for his Liberation Day tariffs, and as he took to the stage with a massive board, he upended the stock market, ignited a global trade war, and threw out decades of foreign policy.

Looking like the host of some sort of twisted game show, Trump’s tailored tariffs took particular aim at China and the European Union as part of his bid to usher in America’s ‘Gilded Age’.

Saying that the US has been “looted, pillaged, raped and plundered by nations near and far, both friend and foe alike,” Donald Trump has imposed a baseline tariff of 10% on all imported goods. This comes as the likes of China have been slapped with 54% customized tariffs.

We previously saw Trump warn about tariffs on imports for foreign vehicles and parts, while the POTUS said retaliation could lead to further raises. Still, the EU and China have already promised their own countermeasures, alongside South Korea declaring an ‘all-out’ response.

The tech scene could also be hit hard by tariffs (BRENDAN SMIALOWSKI / Contributor / Getty)

As various tech experts told Wired how the knock-on effect could strike the tech industry like never before.

We’ve already seen Meta and Nvidia stocks drop by around 5%, while Apple and Amazon dipped by 6%.

Considering Apple and Amazon are two of the biggest companies in the world, and the former makes around half of its revenue from selling iPhones that are manufactured in China and India, it’s not hard to see how these tariffs could soon take a toll.

Trump wants to bring back manufacturing in America, but as so many of our modern devices are typically made in regions like China, the worry is that the cost of these tariffs will soon be passed onto the consumer.

Those at the top are keeping a close eye on things, and despite Trump thinking he’s got America’s interests in his sights, Goldman Sachs just raised the probability of a US recession by this time next year from 20% to 35%.

Trade expert Tibor Besedes mused: “There’s this idea that consumers are willing to pay higher prices for American goods. There’s no evidence of that ever taking place.”

He went on to say that many Americans voted for Trump because they were unhappy with inflation under the Biden administration, suggesting they won’t be happy with Trump’s tariffs if the cost of goods continues to go up – we’ve all seen the rage about the price of eggs.

Despite Trump currently putting an exception on semiconductors to help the US-based Nvidia with its imported parts from Taiwan, political scientist Ian Bremmer has foreshadowed that online retailers like Amazon will be hit hard: “Online retailers will feel the pain, and so will consumer device brands.”

Trump has also closed the de minimis exemption loophole that let consumers import goods from China and Hong Kong for nothing as long they were valued under $800. Alongside Shein and Temu, this is sure to strike eBay and Etsy.

Nick Vyas, founding director of the Randall R. Kendrick Global Supply Chain Institute at USC’s Marshall School of Business, said that while the customer will eventually end up paying, there is a plan for how this could work in America’s favor.

Vyas suggested a multi-year approach where the USA should build a manufacturing infrastructure for semiconductors and defense tech, introduce apprentice programs and boost the labor force for semi-automated industries like automobiles, all while continuing to outsource smaller goods and electronics to other companies.

Even as Trump cheers his tariffs, it’s being described as a ‘watershed’ moment for world trade.

Featured Image Credit: Chip Somodevilla / Staff / Getty

Fears are growing among gamers that the cost of the Nintendo Switch 2 could rise to an eye-watering price.

This is due to the new tariffs put in place by President Donald Trump, which he announced at the White House yesterday (April 2).

On that same day, Nintendo unveiled a closer look at its highly anticipated Switch 2 that is due to be released later this year.

The Nintendo Switch 2 is set to be released on June 5th (CFOTO/Future Publishing via Getty Images)

After much anticipation, the console will finally be available to purchase on June 5th for the price of $449.99.

The original Switch, which was first released back in 2017, launched at $299.99 and remained at that price for years.

However, things could have changed for the second version of the Switch after Trump spoke to the press at the White House Rose Garden.

There, he announced an extensive series of tariffs impacting countries around the world and, unfortunately for Nintendo, this includes countries where it builds its consoles.

Now, gamers are worried that these tariffs, which are up to 49%, could end up hitting consumers’ pockets in the US.

Due to this, some people have raised concerns that the Switch 2 could end up costing buyers upwards of $550.

Gamers fear that Trump’s tariffs could impact the price of the Switch 2 (Chip Somodevilla/Getty Images)

On Reddit, one user wrote: “Not trying to get political but I thought it was important to the price discussion. Some insiders are saying the new tariffs could push the price upwards of 550 dollars.

“Switches are primarily made in China, which now has a 51% tariff and Vietnam, which has a 46% tariff.”

This prompted a response from another user, who said: “$550, instead of playing games I’ll be forced to watch a YouTube ‘let’s play’ for free then.”

A third commented: “I do recall Nintendo saying some months ago that they were ‘preparing for tariffs’, so these prices might just be some early foresight by Nintendo, and it’s affecting other countries since of course Nintendo is not gonna make stuff cheaper in the UK compared to the US.”

Another user agreed, writing: “It’s much easier to announce a high price at launch vs telling us a price and then saying, oops nevermind it’s gonna be $600. I think the current $450 price tag is the inflated price because of the tariffs.”

Time will tell whether Nintendo do change the pricing for the Switch 2 and, of course, there’s every chance that these tariffs could be delayed or altered before they impact the new console.

Featured Image Credit: Chip Somodevilla/Getty Images

The stock markets are all over the place right now, and with President Donald Trump announcing his new 10% baseline tariff on foreign imports, while the likes of China and the European Union are slapped with much higher ones, he’s steadfast on his mission to make America ‘great’ again.

Still, the knock-on effect of Trumpenomics has seen stocks tumble in American giants like Apple and Amazon, with some $2.3 trillion being wiped off the market in just 25 seconds. There are major fears about what Donald Trump‘s tariffs could do to the larger tech scene, with everything from laptops to the Nintendo Switch 2 potentially hitting consumers harder in the pocket.

If things weren’t bad enough for the stock market, ABC News reveals that stocks in Trump’s Truth Social social media platform have taken a dive, but for a completely different reason.

It comes after Trump Media and Technology Group filed an SEC registration on April 1, potentially allowing the President’s trust to sell 115 million Truth Social shares. That amounts to just over $2.3 billion.

Truth Social shares have been dropping since Trump returned to the White House (Alex Wong / Staff / Getty)

Like concerns that Elon Musk’s own brother was selling Tesla stocks, the move has sent shareholders into a spin.

Still, it’s important to note that the filming doesn’t confirm a sale or give any details about what a potential sale could involve. Since Trump returned to office on January 20, 2025, he’s transferred his Truth Social stake into the Donald J. Trump Revocable Trust that’s controlled by Donald Trump Jr.

Despite Truth Social stocks dropping by around 5% since the filing, they’re down 10% in the last week alone. In fact, since Trump returned as POTUS, shares in Trump Media and Technology Group are down a whopping 45%.

This comes after a brief boost last September when he assured investors: “I don’t want to sell my shares. I don’t need money.”

Trump Media and Technology Group is keen to downplay the idea that the big man wants out, releasing a statement saying: “Legacy media outlets are spreading a fake story suggesting that a TMTG filing today is paving the way for the Trump trust to sell its shares in TMTG.

“To be clear, these shares were already registered last June on an S-1 form, and today TMTG submitted a routine filing that re-registers them on an S-3 form in order to keep the Company’s filings effective.

“In fact, there currently is no open window for any affiliate to sell shares.”

Some have noticed that the timing of announcing a potential sale of his Truth Social stakes comes just before his sweeping tariff announcement. Skeptics claim that he planned an exit strategy in case things went wrong with his tariffs, while others say he was always going to leave investors out in the cold.

Elsewhere, University of Florida finance professor Jay Ritter warned how this potential sale could “really tank the share price,” stating: “Trump Media has been pretty unsuccessful at creating an operating business model, but they have been quite successful at selling their stock.”

Then again, with TMTG reporting a staggering $400 million loss against a pretty pitiful $3.6 revenue in 2024, many think the writing was already on the wall.

Featured Image Credit: Andrew Harnik / Staff / Getty

President Donald Trump has always promised to ‘make America great again’, and while we warned he was going to impose some pretty brutal tariffs, his Liberation Day announcement has left jaws on the floor.

If imposing a 10% tariff on all foreign imports wasn’t enough, Donald Trump has levied particularly harsh customized tariffs against China (54%), Vietnam (46%), and the European Union (20%). Mexico and Canada might look like they’ve come out of this unscathed, but having hit by an earlier 25% tariff, both have already felt the wrath of the POTUS.

Trump has made no bones about his beef with China and the EU, but as reported by Forbes, these tariffs will also hit some of the remotest places on Earth.

The 10% reciprocal tariff is set to strike the Heard and McDonald Islands, which are an external Australian territory just under 1,000 miles to the north of Antarctica.

An Australian government website refers to the islands as “one of the wildest and remotest places on Earth.”

The irony here is that the islands are uninhabited, meaning unless the seals and penguins who live there are planning on exporting anything to the USA, there’s little reason to impose the 10% tariff.

All you’ll find on the Heard and McDonald Islands is an abundance of wildlife (MATT CURNOCK / Contributor / Getty)

It’s currently unclear how the Heard and McDonald Islands would be affected, as aside from a small amount of fishing, there’s no economic activity. In fact, the only real thing of note here is the Big Ben volcano that stands at 1.7 miles tall on Heard.

The only way to access the Heard and McDonald Islands is via a two-day boat trip from Perth, with the last visit from humans being a decade ago.

Australian Prime Minister Anthony Albanese responded to the news and said: “Nowhere on earth is safe.”

As Forbes points out, other remote areas are also set to be stung by the tariffs, including the Cocos (Keeling) Islands with a population of less than 600, as well as the Norwegian Arctic islands of Svalbard and Jan Mayen. Again, Jan Mayen has no permanent population.

Also on the list is Norfolk Island that lies 1,600km north-east of Sydney and has a population of just 2,188. Worryingly, Norfolk Island has been levied with a 29% tariff (19% higher than Australia). The Observatory of Economic Complexity data claims that Norfolk Island exported the equivalent of $655,000 worth of goods to the USA in 2023, with $413,000 of that being leather footwear.

Speaking to Reuters, concrete-mixing owner Richard Cottle explained how he thinks his home Norfolk Island being hit with the 29% tariff was simply a ‘mistake’: “Norfolk Island is a little dot in the world. We don’t export anything.”

Fellow resident Guy Duncan added: “Products from Norfolk Island are going to have a 29% tariff? Well, there is no product, so it’s not going to have an effect. They probably don’t even know where Norfolk Island is in the world. It’s just probably an anomaly.”

Albanese concluded: “Norfolk Island has got a 29% tariff. I’m not quite sure that Norfolk Island, with respect to it, is a trade competitor with the giant economy of the United States, but that just shows and exemplifies the fact that nowhere on earth is safe from this.”

Bizarrely, these remote areas are implicated by the POTUS as encouraging “currency manipulation and trade barriers.” While it could simply be some accounting errors, many are amused that these remote (and sometimes uninhabited) locations are on the radar of the USA.